TrinityRail Design Sprint

This case study covers a three-week design sprint to validate the concept of an industry-disrupting self-service tool through competitive and internal research, rapid prototyping, and real user feedback.

the basics

How long was this project? 3 weeks (the bulk of work done during a 3-day onsite workshop)

When was this project completed? July 2022

TrinityRail is North America’s premier railcar products and services provider, with a comprehensive platform of leasing, manufacturing, maintenance, and professional services. Trinity was looking to explore what self-service and flexible railcar access could look like for customers when pursuing and comparing leasing options. During the design sprint, the team developed user journeys and flows, created rapid prototype solutions, and gathered real user feedback in order to validate that their idea would be an innovative option for the company to explore further.

what’s the ask?

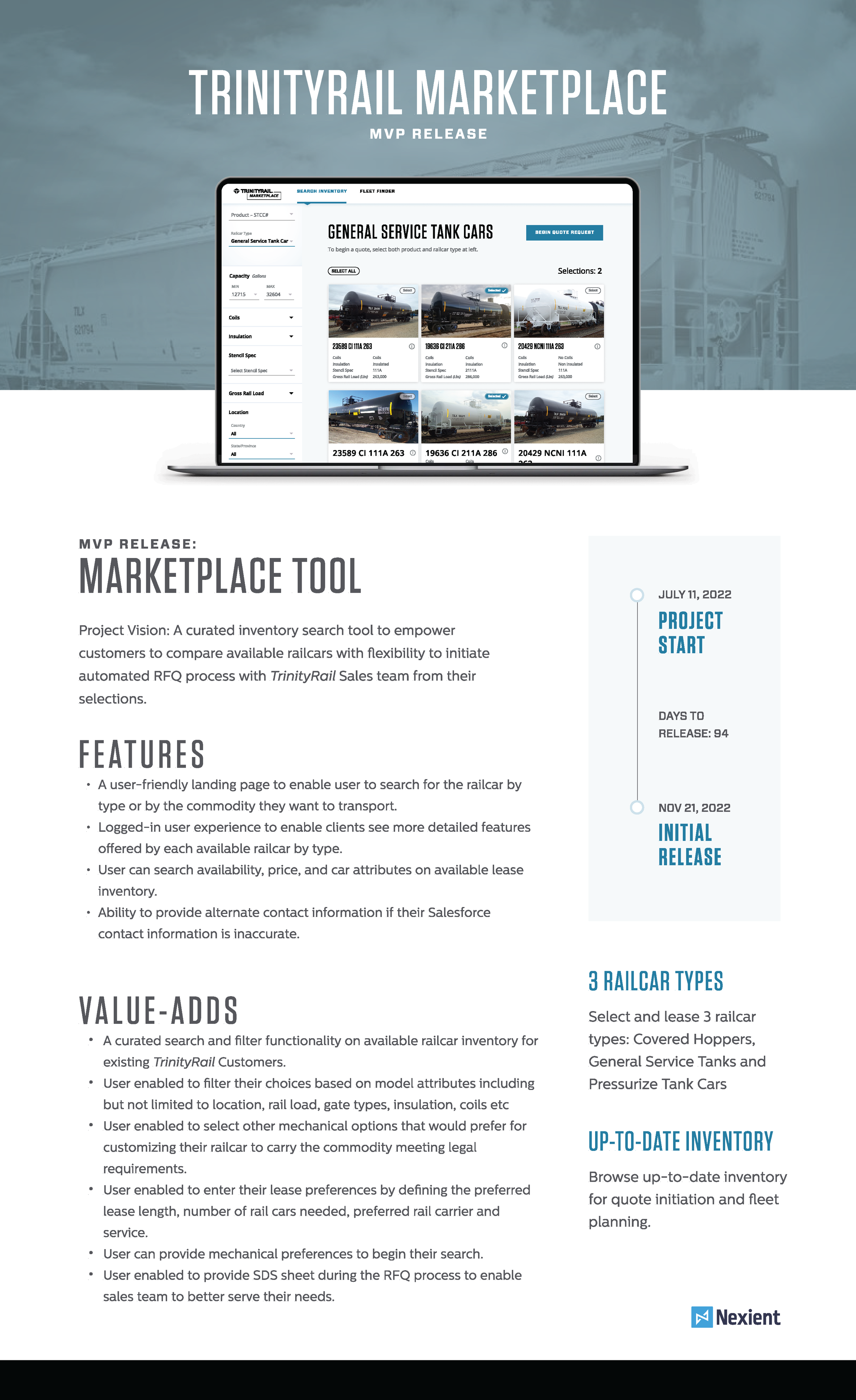

When TrinityRail approached us, their goal was to convince the old-school executives that it was time for TrinityRail to embrace the digital revolution and make it easier for customers by creating a tool that allowed customers to search through inventory, get automated request-for-quotes, and sign their railcars leases within a week.

In order to get approval for their ideas, they needed to prove the following:

their ideas were feasible from a technical, financial, and business decision standpoint

their users actually wanted and would use a tool that enabled them to search inventory and get automated quotes

whatever they create would aid sales representatives in their job, and not remove the need for them

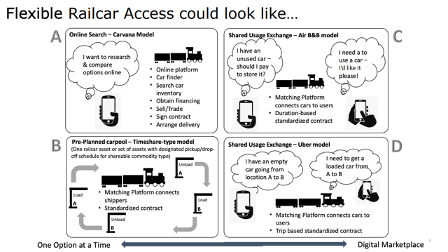

the original concepts TrinityRail were interested in pursuing

my role

UX Designer + Researcher

My role in this project was varied, as all of us took on many hats during the three-week project. I was specifically selected for this project due to my design sprint & user research experience.

While I touched every aspect of the design sprint, my specialty focused on journey mapping, user flows, and user interviews/synthesis. I was in charge of journey mapping and user flows both in pre-discovery and during the workshop. Some of my sketches were used to develop the initial prototype used in testing, and I assisted in creating the low-fidelity prototype.

I spearheaded user research during the project, developing both user interview scripts and personally interviewing all of the participants. I was also responsible for research synthesis and helped validate our clients’ original hypotheses.

meet the team

UX DESIGNER + RESEARCHER

Brooke Lytle

SALES LEAD

Blake Walles

PROJECT LEAD

David Shell

CLIENT PARTNER

Vicki Papa

UX DESIGNER + RESEARCHER

Jessi Mulligan

UX STRATEGIST

Check Wheeler

project constraints

lack of time

The biggest constraint on this project by far was the amount of time we had to run through the entire design process. The entire project was three weeks long, with only three days being in-person with the client. The first week was the pre-workshop discovery. During the second week, we defined the true problem, came up with a solution, designed the solution, and tested the solution with a group of users. For week three, we enhanced prototypes, reinterviewed users, and presented a final solution and recommendations to the client.

technical constraints

Very early on, we learned that there was a major constraint: a lot of the data required to actually build what we wanted did not exist, or was not organized properly. Much of their current leasing process was done manually and data that the sales representatives relied on was not real-time. Because of this, our scope was more limited than we initially thought.

assumptions made

Due to time constraints, we had to make a lot of assumptions in order to continue. We were unable to validate whether our user archetypes were accurate, learn about the intricacies of the railcar leasing process/industry, or do detailed designs or testing.

old school thinking

TrinityRail is an old company in an old industry, and many people working there were set in their ways. Leadership was watching the entire project with a close eye, and some of our interview content and designs had to be changed due to worries that it would “ruffle up some feathers” with current sales representatives or clients.

our design process

*my deliverables

phase 1: understand

Pre-Sprint Discovery

Before the workshop, the team had one week for pre-sprint discovery, which included information gathering, conducting industry research, and competitive analysis. My teammates uncovered nine initial user archetypes: the loyalist, the rationalist, the newbie, the deal finder, the trinity sales rep, the larger lessor, the veteran, the trinity liaison, and the shipper. As a team, we prioritized the two we believed would most benefit from a new tool. The two archetypes chosen were the newbie and the loyalist.

The loyalist represented long-time customers with TrinityRail and maintained multiple leases. He has a go-to sales rep who can anticipate his needs. The loyalist’s biggest concern is maintaining a good relationship with his sales rep in order to streamline the process of securing new lease contracts.

The newbie represented someone who manages shipments for their company and is new to leasing railcars. He isn’t exactly sure what he needs. His goal is to view car availability and book leasing contracts ASAP.

From there, I created user journeys of the current sales process based on those archetypes.

Pre-sprint discovery*

User archetypes refined

Journey mapping*

Archetype refinement

We began the day by reviewing the problem and defining the ask. This included going over our competitive analysis, archetypes, and the above user journeys.

During the competitive analysis review, the group established two marketplaces as examples of how a railcar leasing tool would work: Commtrex & Carvana. These two were chosen as inspiration as they both did a great job of guiding new users through the buying or leasing process and letting more seasoned users get right to the information they were looking for.

This conversation led to the team deciding to pivot the archetypes we wanted to focus on. In the end, the loyalist was replaced by the rationalist. The reason for the pivot came back to the core ask behind the tool we wanted to develop - one that streamlined the leasing process and made it easier for the user to find the railcar they need, receive a quote and sign a lease.

A loyalist was used to the current process, and even thrived using it. They would be less likely than other users to use a new tool, as they have a sales representative dedicated to their every need.

A rationalist, on the other hand, was much more likely to use a tool like this. The rationalist’s main goal is to have the leasing process be painless, and they expect full transparency in terms of pricing and terms. They know what they need, but aren’t loyal to any brand - they value speed, ease, and responsiveness.

Journey mapping

Since there was no journey map developed for the current leasing process for the rationalist, one was created.

Once current journeys were established, we moved on to proposed journeys for both the newbie and the rationalist, showcasing how our new tool would streamline the leasing process for the rationalist and help guide the newbie.

phase 2: define

Defining the problem*

The railcar leasing quoting process is long & difficult, with no insight into available inventory

TrinityRail is a seasoned company, having been in the rail business for 90 years. In the past 10 years, TrinityRail began to struggle as it failed to adjust to the digital age.

The main problem area was the quoting and selling process for railcars. To begin, there was no way for companies requiring railcars to see what TrinityRail had in stock or available for lease without reaching out to a representative on the phone.

The quoting & leasing process was incredibly manual, and the process of sales representatives getting quotes back to potential customers took about three weeks, compared to competitors who could get contracts signed within a few days. As others began to use their websites to speed up the quoting and selling process, TrinityRail began to lose sales to competitors focusing on speed and low pricing.

phase 3: ideate & decide

Individual sketches*

User flows*

Once proposed journeys had been solidified, each member of the UX team spent some time working on sketches, trying to determine how to make each proposed journey a reality.

Individual Sketches

my sketches

my colleagues sketches

We regrouped to take a look at all the individual sketches and discussed each. After coming to a consensus on what would work the best, we took pieces from each to develop two user flows:

New User Flow (focused on the newbie archetype)

Experienced User Flow (focused on the rationalist archetype)

User Flows

phase 4: prototype

Low fidelity prototyping*

Prototype

With user flows established, prototyping began right away, as we had user interviews with clients lined up the following day.

New user flow prototype

Experienced user flow prototype

phase 5: validate

User interview script created*

initial user interviews*

User Interviews

On day three of the workshop, five user interviews were to be conducted. Of course, before that could occur, we would need to know what to ask them about. While the rest of the team was finishing up the prototypes, I was working on the user interview script.

The user interview consisted of screening questions designed to get to know the user better. Next, we asked them about their experience with the current leasing process TrinityRail has. Lastly, I had the user go through the prototypes and asked them about their experience with them. The overarching goal of the user interviews was to see if the clients would use a tool like the one being shown to them and if they believe it would streamline the process.

Interview Participants

ASR Group - the world’s largest refiner and marketer of cane sugar. Not a current Trinity lessor, mid-size fleet (~700 cars)

Valero: manufacturer and marketer of transportation fuels. A large lessor of Trinity, very large fleet (16,000+ cars)

Western Foods: flour and industrial food manufacturer. A small lessor of Trinity, very small fleet (~45 cars)

HollyFrontier: fuel and chemical manufacturer. A large lessor of Trinity, large fleet (4,000+ cars)

Harsco Environmental: industrial and engineering services. A small lessor of Trinity, small fleet (~100 cars)

A sampling of user questions:

When you want to add more cars to your fleet, what is your first step?

Is this the right place to start?

Is there anything missing on this page?

Do these filters look correct to you? If not, what would you put there instead?

Would you use this tool? Why or why not?

If yes, would you use this tool as the first step in your research process instead of reaching out to the sales representative?

User Interview Results

phase 6: prototype (again)

High fidelity prototyping*

Prototype

After coming together and taking a look at the takeaways from the first round of user interviews, the prototypes were improved on and in some cases, updated to high fidelity.

Some key changes:

the structure of the new user path was completely redesigned to mimic the experienced user path, but guide the user more

more relevant details and filters were added to each path

the review page was updated to look less like a shopping cart, and more like a review of previous info

next steps were removed on the success page for the experienced path

Landing page

Search screen

Detail page

New user flow redesign

phase 7: validate (again)

Follow-up interview script created*

Follow-up user interviews*

User Interviews

The second round of user interviews took place the week following the workshop. There were four participants, with three being clients interviewed in the first round and one being a new client.

With the repeat participants, questions focused on improvements to the process and if any opinions had changed. With the client seeing the prototypes for the first time, we asked them many of the initial questions we asked in the first round of interviews. The main goal of these interviews was to again determine if they were likely to use the tool but to also gauge if there was a positive change in opinion from the first round of interviews.

Interview Participants

ASR Group: the world’s largest refiner and marketer of cane sugar. Not a current Trinity lessor, mid-size fleet (~700 cars)

K+S Potash: Canada/US potash producer. Not a current Trinity lessor, small leased fleet (50 cars)

HollyFrontier: fuel and chemical manufacturer. A large lessor of Trinity, large fleet (4,000+ cars)

Harsco Environmental: industrial and engineering services. A small lessor of Trinity, small fleet (~100 cars)

A sampling of user questions:

Is there anything missing on this page?

What information on this page do you think it not needed/relevant?

Has your opinion changed since last time?

Would you use this tool? Why or why not?

What else do you want to be able to communicate to us? Where would you want to include that information?

User Interview Results

All participants continued to agree the tool would be useful in order to search inventory. All participants said they would use the tool as the first step in the searching/quoting process instead of directly reaching out to a sales rep, which is a change in opinion for two participants previously interviewed.

All users reiterated that the tool must have accurate real-time inventory information and detailed car specifications for the tool to be useful. Additionally, they preferred the main search tool (designed for an experienced user) over the ”New User” tool, even when instructed to behave as someone new to rail.

Some other key themes throughout the interviews:

Users loved the visuals of the prototype, with websites CarMax and Cars.com brought up as comparisons.

Half of the users said the price was integral for them to use the tool, the other half said it was appreciated, but not required

Location and model main filters continue to be debated, with some users finding them extremely useful and others finding them unnecessary.

Build year is very important and needs to be available, potentially in main filters or at the individual level

It is critical to know when cars are available, and some are willing to pay more to get a car faster

“I like the concept of having visibility at your fingertips… You don’t want to take up a rep’s time if you can use this tool. It gives you an indication of what’s available and what funds you’d need. If you didn’t know people, you wouldn’t know where to start, and this tool gives you some direction.”